Updated 3/4/17; Originally published 4/30/16

Takeaways

- Flipping can be done in Killeen, and the MLS can be a lead source.

- But the MLS is probably not the best lead source. (Target off market or auction properties)

- Most flips are bought between $30,000-$100,000 with target ARVs around $90,000-$160,000

1/3 of Americans rent.

2/3 of Fort Hood-ers rent.

The area is a very landlord friendly market, and for that reason, I mostly see buy-and-hold type investors in our area. But that is not to say there are not flippers!

Curious to put some numbers to the flipping, I looked back on the Fort Hood MLS for every home that has closed twice since January 1st, 2016. Sure enough, they nearly all appear to be flips. The results for the 23 homes I found are below (for privacy, I omitted the address):

List of Fort Hood MLS Flips in 2016

| Neighborhood | City | Seller Type | 1st Sale Price | 2nd Sale Price | Difference | DBC |

|---|---|---|---|---|---|---|

| Tanglewood North | Harker Heights | Foreclosure | $72,000 | 130,000 | $58,000 | 218 |

| Saddleridge Estates | Killeen | Foreclosure | $94,214 | $140,000 | $45,786 | 63 |

| Killeen Heights | Killeen | Foreclosure | $40,000 | $70,900 | $30,900 | 321 |

| Western Hills | Killeen | Foreclosure | $54,100 | $87,900 | $33,800 | 97 |

| Castle Heights | Killeen | Owner | $33,000 | $59,900 | $26,900 | 147 |

| Onion Creek Estates | Killeen | Foreclosure | $109,900 | $165,000 | $55,100 | 175 |

| Len Schwertner | Killeen | Foreclosure | $47,018 | $87,500 | $40,482 | 190 |

| Mountaintop | Copperas Cove | Foreclosure | 40,000 | $72,750 | $32,750 | 280 |

| Chimney Corners | Killeen | Foreclosure | $41,000 | $95,000 | $54,000 | 145 |

| Brookhaven | Killeen | Foreclosure | $80,000 | $125,000 | $45,000 | 74 |

| Sunflower Estates | Killeen | Foreclosure | $122,905 | $150,000 | $27,095 | 95 |

| West Ridge Estates | Killeen | Foreclosure | $81,500 | $129,900 | $43,400 | 93 |

| South Meadow | Killeen | Foreclosure | $62,000 | $85,500 | $23,500 | 133 |

| Splawn Ranch | Killeen | HUD Home | $115,570 | 165,000 | $49,430 | 125 |

| Goodnight Ranch | Killeen | Foreclosure | $94,214 | $127,000 | $32,786 | 88 |

| Conder Valley | Killeen | Foreclosure | $75,000 | $122,169 | $47,169 | 106 |

| Sunflower Estates | Killeen | Foreclosure | $86,000 | $150,000 | $64,000 | 110 |

| Cherokee Lane | Harker Heights | Foreclosure | $66,000 | $129,900 | $63,900 | 155 |

| Trimmier Estates | Killeen | HUD Home | $105,100 | $172,000 | $66,900 | 192 |

| Cedar Creek Estates | Copperas Cove | Owner | $72,000 | $154,000 | $82,000 | 238 |

| Western Hills | Copperas Cove | Foreclosure | $43,275 | $99,900 | $56,625 | 119 |

| Deorsam Estates | Killeen | Owner | $114,500 | $160,000 | $45,500 | 143 |

| Bellaire Height | Killeen | Foreclosure | $45,000 | $65,000 | $20,000 | 228 |

DBC is an acronym I made up for “Days Between Closings”

All closed sales listed between 1/1/16 and 3/1/17 were reviewed.

The “difference” column looks extremely attractive in many of these cases. The reality, however, is that the investors probably made $10,000-$20,000 in profit on most of these, if they were successful at all. I have no way of knowing what these flipper’s expenses and numbers look like, and cannot estimate what any actually profited on any given flip. Transaction costs in the Fort Hood Area are usually about 10%. Subtract anywhere from $10,000 to $30,000+ in repairs, and you can do the math on what their profits may have been. Even so, I think this is a great snapshot of what kinds of numbers investors are targeting with the MLS as a resource.

The “difference” column looks extremely attractive in many of these cases. The reality, however, is that the investors probably made $10,000-$20,000 in profit on most of these, if they were successful at all. I have no way of knowing what these flipper’s expenses and numbers look like, and cannot estimate what any actually profited on any given flip. Transaction costs in the Fort Hood Area are usually about 10%. Subtract anywhere from $10,000 to $30,000+ in repairs, and you can do the math on what their profits may have been. Even so, I think this is a great snapshot of what kinds of numbers investors are targeting with the MLS as a resource.

This is just a fraction of some of the flips that have taken place in our area, and only ones from the MLS as a resource. This list does not include the myriad alternate ways investors find deals: auctions, bandit signs, “driving for dollars”, direct mail, probates/estates, tax liens, etc.

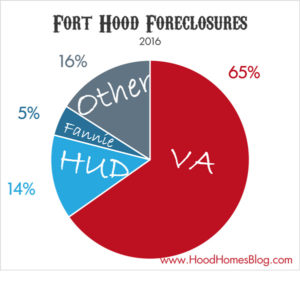

Nearly all of these were VA foreclosures.

Why the MLS is Not the Best Resource

Foreclosures are one of the easiest property leads for an investor to find. They are visible on the MLS, Zillow, Realtor.com – everybody can see them! Worse, many of these were VA foreclosures, which usually doesn’t accept offers until a few days on the market. That means every investor has had time to see it and get an offer in. The best deals will always get bid up.

Foreclosures are one of the easiest property leads for an investor to find. They are visible on the MLS, Zillow, Realtor.com – everybody can see them! Worse, many of these were VA foreclosures, which usually doesn’t accept offers until a few days on the market. That means every investor has had time to see it and get an offer in. The best deals will always get bid up.

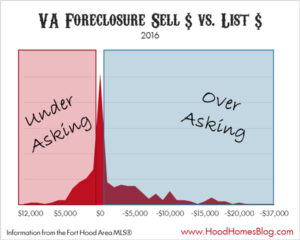

Plus, many foreclosures in our area are actually in pretty good condition. If the building is in too good of condition, you will probably be competing with owner-occupant retail buyers, who obviously will be paying well over whatever an investor would for the same property. You aren’t going to (and don’t want to) compete with retail buyers.

Not all good deals start a hot deal. Many of these came on the market at a hot price, saw multiple offers, and sell over asking. Others went under contract, fell out, went in, fell out, until finally selling to an investor who was satisfied with it. But others sat on the market, seeing price drop after price drop until finally it fell into a range that was a deal. That is why I search three things when looking for deals:

- new listings

- price drops

- properties back on the market

Most banks, and the VA especially, seem to do $5000 or $10,000 price drops every 30 days on the market if they haven’t found a buyer yet. So it is worthwhile to stalk foreclosure listings that are nearing 30, 60 or 90 days on the market. Longer than that, the banks are usually entertaining any and all offers, so go for it! (not many make it that long – and usually there is a reason).

Fort Hood Challenges for Flippers

The Fort Hood market presents some challenges for flippers versus other markets. I’ve seen several investors come into our market with their expectations misaligned to reality, and watched them get burnt out in short order.

The VA Loan

100% financing plus rolling in the funding fee means that many Fort Hood buyers are under water on their mortgage for years after buying their home. 57% of buyers used the VA loan in 2016 in the Fort Hood area.

Big mortgages mean many home sellers have little or no equity, making deals harder to come by without some creativity.

Builders

Fort Hood has a lot of builder activity. The average home that sold in 2015 was built in 2001 – just 15 years old. There is very little “gentrification” because home buyers are often sucked away to the newer developments in town like Tuscany Meadows, Splawn Ranch, or Heartwood Park. People won’t buy your sweet flip with awesome upgrades when they can get the same thing in a brand new home.

Transaction Costs

Fort Hood has a healthy market with approximately 5 months’ inventory, but still strongly behaves like a buyers’ market. That means in addition to Realtor commissions, buyers expect closing costs, title policies, surveys, repairs, and home warranties to all be paid for by the seller. These items are all negotiable. But they are so common that local appraisers by default assume that the seller paid the closing costs when they do an appraisal. This invariably adds $1000s to your flipping costs that you may not have experienced in other markets.

Where Can You Find Fort Hood Area Flip Leads?

I’ve witnessed folks have success with all sorts of off-market (i.e. not on the MLS) leads in our area. Direct mail, bandit signs, craigslist, and the auction would be the lead sources I would recommend considering if you are looking to invest in our area. I would strongly consider direct mail in particular. I have personally done some mailings with great success. Be sure to get a reputable list and mailing company (I used

I would strongly consider direct mail in particular. I have personally done some mailings with great success. Be sure to get a reputable list and mailing company (I used Listsource and YellowLetters.com). I searched zip codes 76542, 76543, 76548, 76549, 76522, and 76559 for homes with 40-100% equity and tax appraised value between $90,000-$250,000, built after 1978.

Where Should I Start?

Bigger Pockets

The first place to learn more about investing in any market is Bigger Pockets. It is a one stop shop for investor information. The articles, forums, and hundreds of podcasts are indispensable for investors of any skill, type, and location. If you are new to investing, this if the very first resource you should check out.

You will also want to set up alerts for your geographic area of interest (e.g. “Killeen” and “Fort Hood”) so that you will be alerted any time someone posts in the forum or a deal in your area.

Killeen Investor Meetup

There is a local group that meets every first and third Thursday at El Chico on Highway 190 (I-14).

The event is highly informal – often between 6 to 15 folks show up around 11:30 AM, order lunch, and talk real estate. There are a few experienced investors, a few agents like myself, and a few newbies. It is a low pressure place to just learn more about the area if you are new, and make a few connections!

Bell County Auction

The local auction is the first Tuesday of every month at the Bell County Justice Center in Belton, beginning at 10 AM. The auction properties are available for free on the County website. However, the information is often in legal description and time consuming to break down on your own. The auction pros pay for and use a foreclosure listing service.

Bell County Justice Center

1201 Huey Dr

Belton, TX 76513

The point of the auction for beginners, however, is not to bid on properties, but to connect and learn from the major, local cash buyers. It is also an invaluable education for learning about the life cycle of distressed properties.

Note: Copperas Cove is in Coryell County; their auction is separate and held in Gatesville, TX.

Conclusion

Flipping in Fort Hood is not for the casual investor. It will take a lot of work to make money at it, let alone make a living. Only a few do it successfully at the moment.

But don’t let that discourage you! As always, real estate investing has many different ways of making money, either flipping, wholesaling, whole-“tailing”, flip-and-holding (aka “BRRRRing“), house hacking a multifamily, or more. Hopefully this included some helpful perspective on the Fort Hood area and where to begin to start making your real estate mogul dreams come true.

Brian E Adams, REALTOR®

I am a real estate agent in the Fort Hood area, with StarPointe Realty. Contact me for help buying and selling in Central Texas!