Takeaways

Takeaways

- The median price point for Fort Hood and most areas rose modestly in 2016.

- But beneath that ho-hum uptick are some very favorable trend lines for area homeowners.

- Multi-family prices have most plateaued, for now.

Median Price

Median Price

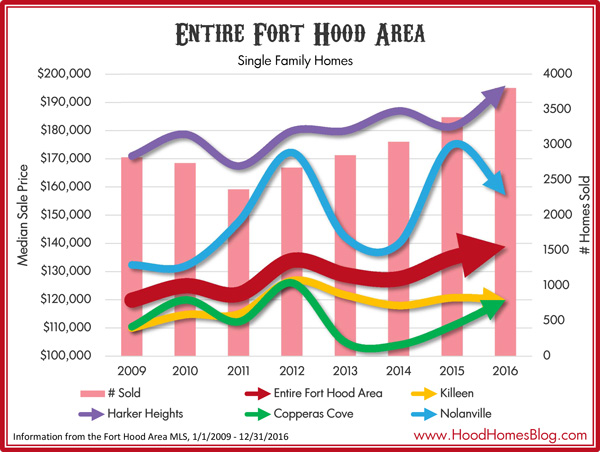

The Fort Hood area’s median price climbed from $135,000 in 2015 to $138,857 in 2016, a modest 2.9% price increase.

The growth was spurred mostly by improvement in the Harker Heights and Copperas Cove markets specifically, while the Killeen market actually saw a a $750 median price drop versus 2015.

Nolanville looks a bit crazy, but that is due to being a smaller community (small sample size), and also having about half the neighborhoods under $140,000 and the other half over $180,000. With little priced in between, the media price jumps back and forth between those two price points.

Days on Market

Days on Market

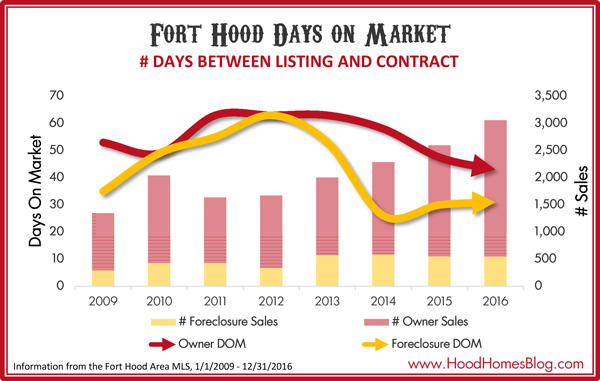

The aftershocks of the Great Recession were hardest felt in the Fort Hood area in 2010 through 2012, which is reflected in the higher days on market during those time. After a high of 63 days on market for non-foreclosure sales in the years 2011-2013, it has been declining ever since to a new, healthy low of 43 days before a home goes under contract.

Note that this is just for homes that sell – as many as half of homes listed on the MLS do not sell, and aren’t reflected here.

2010 saw a large increase in home purchases that wouldn’t again be equaled until 2014, likely on account of the one time $8000 home buyer tax credit the government passed for that year.

Foreclosures

Foreclosures

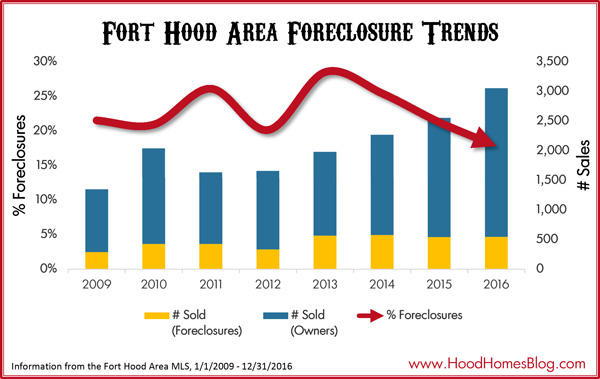

The Fort Hood housing market mostly weathered the Great Recession well, as did much of Texas. But it was still affected, most noticeably by a sharp decline in real estate activity in general, and a noticeably rising foreclosure rate.

Since 2013, that foreclosure rate has steadily dropped – or rather, stayed mostly the same as a raw number while total number of non-foreclosure sales have risen.

That is great for area homeowners and sellers as their homes will have fewer discounted foreclosure properties dragging down prices and luring budget conscious buyers away.

Listing Result

Listing Result

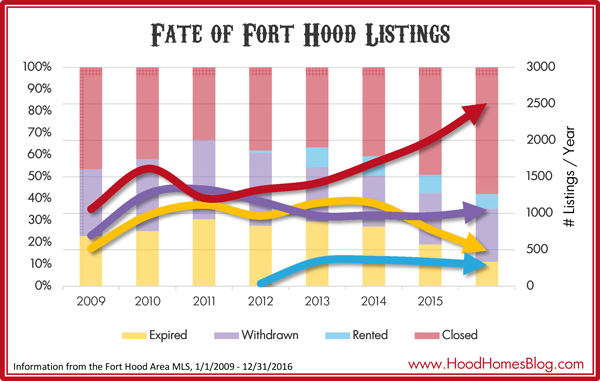

Most of the data on this page reflects homes that sold.

But what about the many that did not sell?

Here we look at how many homes expired, were withdrawn, or rented prior to selling. Some of these withdrawn or expired homes may have sold later in the year, but it is still a useful gauge to see how successful home sellers are at getting their homes sold. Note that the Fort Hood MLS only started tracking homes that rented instead of sold in late 2012.

We again see what a tough couple years 2011-2013 was. More listings were withdrawn in 2011 than actually sold, and nearly as many expired, as well, meaning scarcely 30% of MLS listings ever actually sold.

But things have improved a lot! 2016 was a great year for home sellers, 58% of whom found their homes selling instead of expiring or having to withdraw them from the market. Only 487 listings expired, the fewest since before 2009 and a huge improvement over the 1142 listings that expired in 2013.

Seasonality

Seasonality

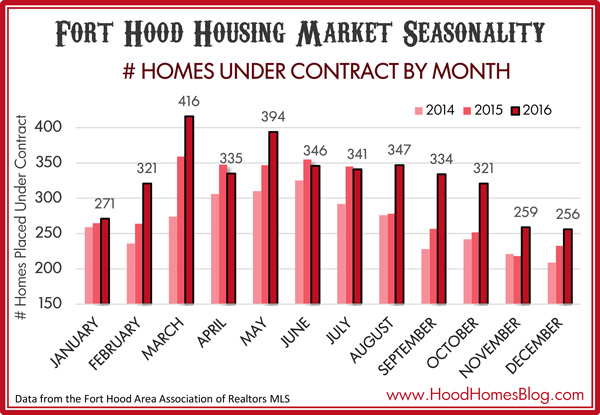

When is the best time for a seller to be on the market?

Not when the most closings happen (usually mid to late summer). It is when the most offers are being written.

To learn that, I look not at sales by month, but homes that went under contract by month. Note that not all of these closed – some fell out of contract later. But this best represents when, in past years, the sales market has been hottest.

As you can see, March in particular is not only when things get hot, but was the hottest month for home sale in 2016 (buyers doing their home hunting over spring break?). For home sellers, it’s a good idea to get on the market early in the new year. 2016 broke the mold a little bit versus previous years, however, and maintained a fairly hot Austing-October.

A major driver of seasonality in the Fort Hood area is of course “PCS season” in the Army. Or unit deployments may impact the numbers. But even then, there are not many outlier months. Early in the year is the best time to be getting on the market, and brace yourself if you are selling in November. You may have to wait until after the holidays to find that buyer.

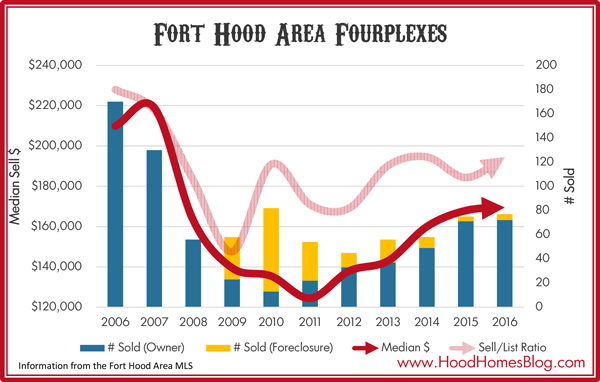

Fourplexes

Fourplexes

After a lackluster few quarters, I began to wonder in late 2016 if fourplex price appreciation had plateaued.

Sure enough, after a turbulent few years between 2010 and 2013, 2016’s numbers very nearly match those of 2015. The median price rose from $168,000 to $169,500. 77 sold in 2016 versus 75 in 2015, 5 of which were foreclosures versus 4 in 2015.

I’ve worked with many investors still seeking out foreclosures, but the current prices work out to just barely an acceptable cap rate for what many are comfortable with. Given the dearth of fourplex options in other parts of Texas like Austin, would-be multi-family owners are still flocking to the area. But there isn’t much room left for prices to grow and still be an investor worthy purchase. At least, not until rents begin rising (which I don’t foresee in the near future).

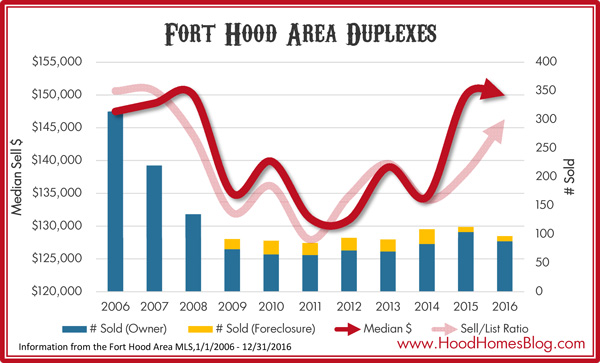

Duplexes

Duplexes

Duplexes are generally flying off the shelves, so it seems. There are only two months’ inventory of duplexes as of this writing – the sign of a hot seller friendly duplex market.

Builders have taken notice, as the current duplex building is still going strong, and additional duplex developments are in the works in the Killeen area.

But you wouldn’t know any of this from just observing the median price for duplexes. The median price actually fell $50 from $150,000 in 2015 to $149,950 in 2016. But the list/sell ratio improved to a healthy 99.3% of the asking price.

What will 2017 bring?

Anecdotally, 2017 has already gotten to a hot start for myself and and other agents I work with and have spoken to. 2016 didn’t see major climbs in the price points, but all the other trends point toward a more favorable sellers market as the market firms up, homes sell faster, and foreclosures fewer.

There are some major extrinsic factors like rising interest rates and potential new federal housing policies with the CFPB, Fannie Mae and Freddie Mac that could push the market one way or another. But barring a significant external disruption, I expect to see homes values rise at a faster clip in 2017 than they did in 2016.

Brian E Adams, REALTOR®

I am a real estate agent in the Fort Hood area, with StarPointe Realty. Contact me for help buying and selling in Central Texas!