“The mortgage calculator says my principal and interest is only $680/mo. Then why is my mortgage payment more than $1000/mo?”

“The mortgage calculator says my principal and interest is only $680/mo. Then why is my mortgage payment more than $1000/mo?”

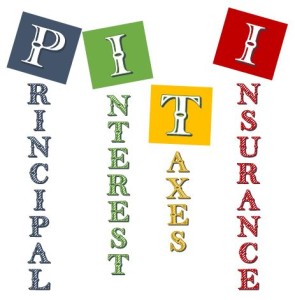

Your mortgage payment probably includes 4 things: Principal, Interest, Taxes and Insurance. In the real estate industry, this is often abbreviated PITI. When a lender estimates your monthly mortgage, this number is what they are quoting.

Why do I pay taxes and insurance with my mortgage payment?

Your lender is making you likely a massive loan – perhaps the largest loan you will have in your entire life. But the lender has some protection if you fail to pay on that loan. Your house.

Therefore, your lender is actually just as keen that your house be kept in good condition as you are. They want to make sure you A) have property insurance in case something goes wrong and B) pay your taxes so the government doesn’t come take away your property (and their collateral). Therefore, lenders usually will require you to pay your taxes and insurance in monthly payments to them, the lender, and the lender will pay your insurance and taxes. It actually works out great, because you as the homeowner don’t have to worry about paying those things! I’ve even had cash buyers without a lender ask how they can pay their taxes and insurance monthly to someone, because it is just a lot easier than paying it in lump sums once a year (you can pay a fee to a bank to escrow those funds and pay them for you).

What is an escrow?

Your lender collects an estimated amount for your taxes and insurance monthly, but they are paid once annually. That means they are keeping that money (YOUR money) somewhere. It is safe in an escrow. Usually the balance of your escrow will be included in mortgage statements. If not, you can request a payoff statement from your lender (the amount it would cost to pay off your loan) which will include information on the escrow.

When you sell your home, you probably will have at least some money in your escrow depending on what time of year the closing is and when your taxes and insurance were last paid. It is likely that your lender will have collected estimated amounts for insurance and taxes that you won’t be paying after you’ve sold, and therefore sellers often get the remainder of their escrow refunded to them a couple weeks after closing (often anywhere from $0 to several thousand dollars).

You also might get annual refunds if they estimated and collected too much, so be sure to open your mortgage statements that you get between January and March or so! It may have a check for you!

Conversely, they may have underestimated your taxes and insurance, in which case in my experience they will usually make up the difference not by requiring a single lump sum payment from you but by raising your mortgage payment to cover the amount over 12 months.

Principal and Interest

This amount is easily calculated as long as you know the sum of your financing and mortgage rate. The amount of your loan that is principal and interest will NEVER change (in fixed rate loans). You can calculate this using any simple online mortgage calculator.

“Why did my mortgage payment go up then?”

Taxes

Your mortgage payment might go down or (more likely) up from year to year. The most probably cause are your taxes and insurance are getting more expensive.

Taxes are generally paid in October, and can dramatically affect closing costs. That is a subject for another article entirely. Property taxes in Texas tend to be much higher than other States, and will generally be hundreds of dollars each mortgage payment.

If you notice your taxes go up a lot, it may be the new year tax assessor decided your property was worth more. New assessments generally come out around May or so, and you will be notified by mail from the county tax assessor. It is possible to appeal your taxes if your assessed property value is well more than what you think it should be (the only time you want your property value to be low is when the government is taxing you on it!).

Check out here for more information on Fort Hood area taxes.

Insurance

You can’t do much about your taxes, but you have a lot of control over the insurance. You pick the property insurance. Often, if your final mortgage payment is higher than what your lender originally estimated, it is because the insurance you chose was more expensive than what they were estimating.

You don’t need to choose your insurance until a week or two before the closing, so it is fine to take your time and shop around. Shopping for insurance is a great thing to do to keep your mind busy if you’ve already done everything else for your agent and lender and are looking for something to do to help keep things moving.

Mortgage insurance is also part of your mortgage payment. It is called PMI (private mortgage insurance) or MIP for FHA loans (mortgage insurance premium). Unlike property insurance which insures your home, mortgage insurance insures your mortgage (duh!) and helps repay the lender in the event that you are foreclosed. Several loan types have no mortgage insurance, and with all loan types it is possible to avoid mortgage insurance if you have enough for a decent down payment (20%). High loan-to-value loans (where you borrow more than 80% of the money) are higher risk, which is why lenders may require mortgage insurance.

Even if you started with mortgage insurance, once you completely own around 20% of your home (20% equity) you are usually able to get your mortgage insurance removed and save yourself $100/mo or so. Currently, you cannot do that with MIP on an FHA mortgage, one of the major downsides of FHA loans.

“How can I estimate my mortgage?”

I created an example for VA loans here, but in reality the only good way to start finding out what your mortgage payment will look like is to talk to a lender and get a pre-approval. This step is no commitment, always free, and Step #2 in the process of buying a home. The local Fort Hood area lenders I recommend are below!

View Recommended Local Lenders