Takeaways

- The Fort Hood market had a fantastic 2017, with median price growth of 11% over 2016.

- Median fourplex prices grew 14% over 2016

- Foreclosures hit a new low at just over 14% of home sales

- Inventory is approximately 4 months, creeping closer to a seller’s market

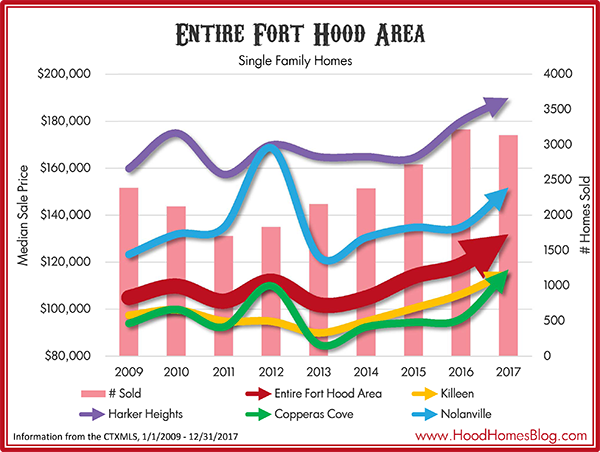

I’ve defined the Fort Hood market area as Killeen, Copperas Cove, Harker Heights, Nolanville, Gatesville, Kempner, Lampasas, and Florence.

Median Price

The Fort Hood area median price climbed from $118,950 to $132,000 in 2017 (including foreclosure sales), a striking 11% growth. That was with slightly fewer sales than in 2016 with approximately 3137 total non-builder MLS sales. Every city in the Fort Hood area saw benefits, with median prices rising across the board, with incredible 21.9% growth in Copperas Cove, seeing its median price just eclipse Killeen.

- Killeen – $116,000, 8.9%

- Harker Heights – $189,900, 5.5%

- Copperas Cove – $117,000, 21.9%

- Nolanville – $151,875, 12.5%

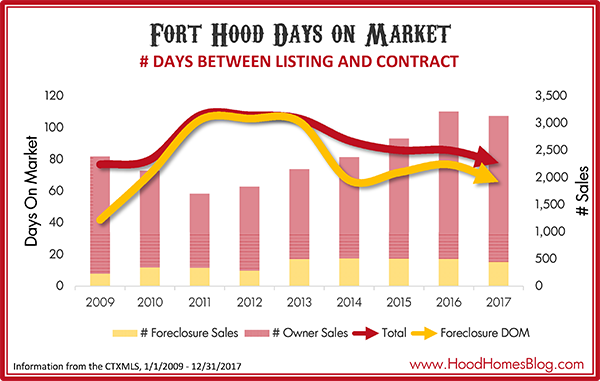

Days on Market

Median days on market dropped slightly from 2016 to 78 days (from listing to closing), down from 86 in 2016. Foreclosures sell slightly more quickly.

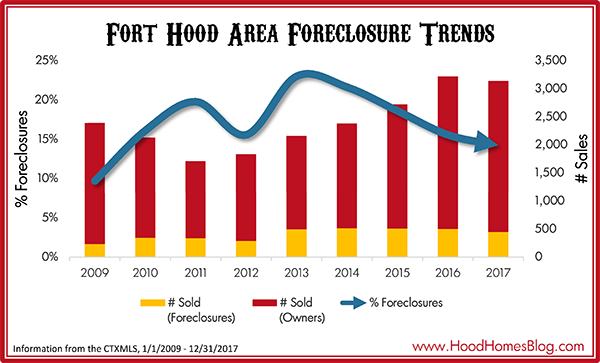

Foreclosures

The Fort Hood area survived the Great Recession reasonably well versus other markets in America. But foreclosures as a percentage of the market were still considerable. Foreclosures fell slightly from 507 total sales in 2016 to 447 sales in 2017, for 14.2% of Fort Hood area sales, the lowest percentage of sales since 2009. This drop in foreclosures is partly responsible for the rising area prices. Even median foreclosure prices rose from $80,000 in 2016 to $90,000 in 2017.

The worst year for area foreclosures was 2013, with 497 foreclosure sales, but those comprised 23% of Fort Hood sales.

Foreclosures are a consistent feature of the Fort Hood market, even while growing, due to a variety of factors including the prevalence of the VA loan.

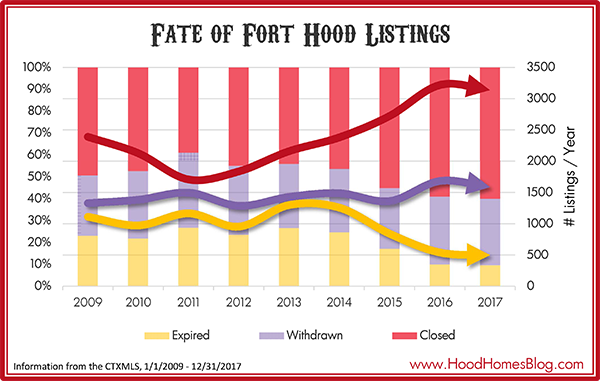

Listing Result

60% of listings ended with a closing in 2017, an all-time high for the Fort Hood area through 2009 (2016 was 59%). 30% were withdrawn and 10% expired.

Some homes that withdrew or expired may have sold later in the year and may be counted multiple times.

Expired listings are those that go their full listing term without selling, usually 6 months. Expireds are at an all-time low after comprising 37% of listings in 2013 and 2011, with only 500 listings expiring in 2017.

Withdrawn listings are down from 31% of listings to 30%. Withdrawn listing include those that were pulled from the market because the home rented before it sold. Any other reason a seller pulls their home off the market prior to the expiration of the listing agreement results in a Withdrawn status.

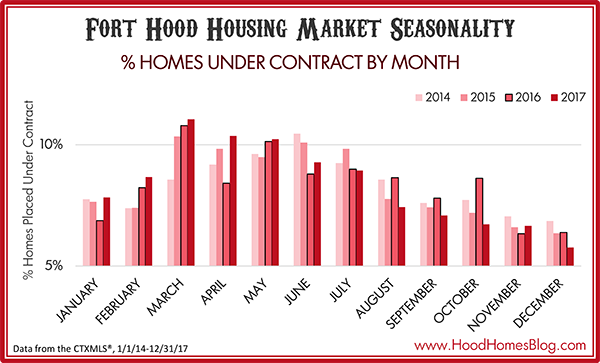

Seasonality

March is hot-hot-hot! This is a graph not of closings by month, but contracts by month. After all, the closing is a result of a contract, not the other way around. You want you home on the market when buyers are making offers, not closing on other peoples’ homes.

Another big question about Fort Hood are the military PCS and deployment cycles and how those impact the market. You can see there are a few outliers that might be explained by a military rotation – October of 2016 or April of 2017 were unusually hot months. But for the most part, the first six months of the year is when most of the action happens, and it’s probably not useful to worry too much about timing the season.

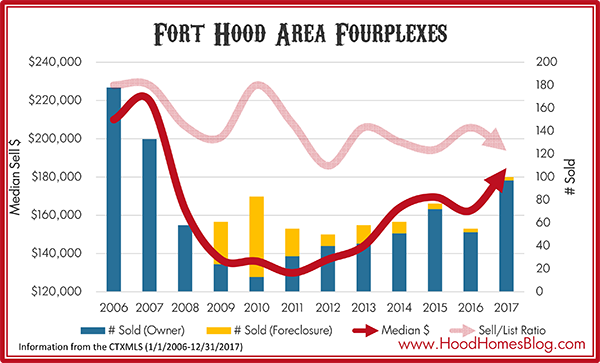

Fourplexes

The Fourplex market had an excellent 2017, with the median sales price rising over $20,000, a 14% increase over 2016, to $184,700. From my own observation and experiences, most of that improvement took place with sales in the second half of 2017, suggesting the median price will be yet higher in 2018.

The fourplex market is fairly dramatic as the graph shows. 4/5 fourplexes in 2010 were foreclosures, with the median price bottoming out at $129,900 in 2011. That was due to the Great Recession. Many fourplex owners were out-of-state investors caught in firesales. Even though the Killeen market weathered the storm reasonably well, the fourplex market crashed. Those who could hold on did well, as rents were mostly unaffected. There have been no new fourplexes built since 2008.

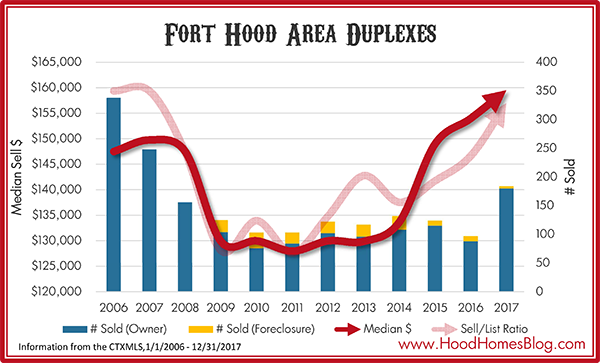

Duplexes

Like fourplexes, duplexes were impacted by the Great Recession, but not nearly as severely. That is because duplex owners are more likely to be owner-occupants, locals, or military investors who didn’t get caught with their pants down by the housing crash.

Duplex numbers have rebounded nicely, with a median price of $159,550 in 2017 and significantly more duplexes selling in 2017 than 2016, partly due to a significant uptick in builder duplex activity.

What will 2018 bring?

11% is not sustainable, and I predict 2018 will not grow at the same rate. There were a lot of positives driving the 2017 numbers, including new commercial development and completed infrastructure improvements, especially the designation of I-14 and expansion of Hwy 195. Inventory is relatively low which may keep upward pressure on prices, and empirically building has slowed just some. But also surrounding markets like Austin have tempered their pace and I expect to see a consolidation of these gains rather than dramatic leaps.

What will be interesting to see is if rising prices starts make rentals more attractive, which would then put upward pressure on rents. Rentals have not gone up significantly in the last 10 years and even a slight increase could bring investors and more interest to the area.

Conclusion

These numbers are general and do not necessarily reflect your own home or neighborhood. Part of these numbers may be reflected by newer and more expensive subdivisions being built, instead of existing subdivisions seeing significant price increases. Don’t assume your home’s value has jumped 21% simply because it is in Copperas Cove. Talk to a Realtor to find out the market situation of your own home.

That said, it’s always good for homeowners and sellers to see prices trending positively. For buyers, it makes it harder to get as much on your budget as buyers could even just a couple years ago, but the area as a whole is still extremely affordable with a median sales price of $132,000. With such a low cost of living, this market is not inflated and won’t be for a long time.